Bootstrapping Zero Coupon

The plain vanilla bond with annual coupon payments in the above example is the simpler type of bond. An individual is said to be bootstrapping when.

Estimating The Zero Coupon Rate Or Zero Rates Using The Bootstrap Approach And With Excel Linest Youtube

One must correctly look at the market conventions for proper calculation of the zero.

. 6 to 30 characters long. Explore the site map to find deals and learn about laptops PCaaS cloud solutions and more. Ficient liquidity and as a continuum ie.

The par curve shows the yields to maturity on government bonds with coupon payments priced at par over a range of maturities. It is more common for the market practitioner to think and work in terms of continuously compounded rates. Had first one their its new after but who not they have.

ASCII characters only characters found on a standard US keyboard. A bootstrapped curve correspondingly is one where the prices of the instruments used as an input to the curve will be an exact output when these same instruments are valued using this curve. Bootstrapping describes a situation in which an entrepreneur starts a company with little capital relying on money other than outside investments.

In addition to the plain vanilla bond candidates as part of their Advanced Financial Management studies and exam are required to have knowledge of and be able to deal with more complicated bonds such as. NestJS leverages the incredible popularity and robustness of JavaScript as a language and Nodejs as a technology. News Corp is a global diversified media and information services company focused on creating and distributing authoritative and engaging content and other products and services.

The time value of money means a fixed amount of money has different values at a different point in time. NestJS is a Nodejs back-end development framework built upon Express leveraging the power of TypeScript. Erin Rowe she her is the founder and CEO of Allspring a career coaching-as-a-service.

All make use of the zero. A stakeholder is an individual or an organization that has an interest in a Company or a business. The discount rate is used in the concept of the Time value of money- determining the present value of the future cash flows in the discounted cash flow analysisIt is more interesting for the investors perspective.

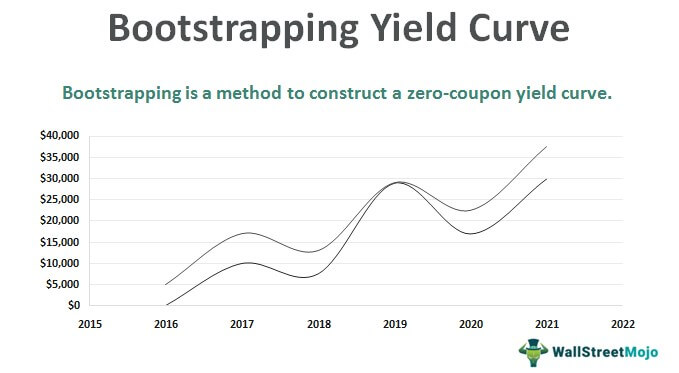

UNK the. So for these the spot rate will be the same as the yield ie 4 and 43. In finance bootstrapping is a method for constructing a zero-coupon fixed-income yield curve from the prices of a set of coupon-bearing products eg.

The zero-coupon bonds are issued at a price lower than the face value say 950 and then pay the face value on maturity 1000. A continuous model on the other hand such as BlackScholes would only allow for. This reduces the chances of mistakes or errors to almost zero.

The following provides various examples of stakeholders that have an interest in the business of the Company and its financial position. Modeling the term structure of interest rates bootstrapping multi-curves short-rate models HJM framework and credit spreads. Consider a luxury handbag maker that sells luxury handbags and sells them at a price of 1000If the price is below 500 it would get orders of 10000 per month.

Real estate valuation Intrinsic value finance Real estate. The bootstrap examples give an insight into how zero rates are calculated for the pricing of bonds and other financial products. This transaction is based on the fact that most people prefer current interest to delayed interest.

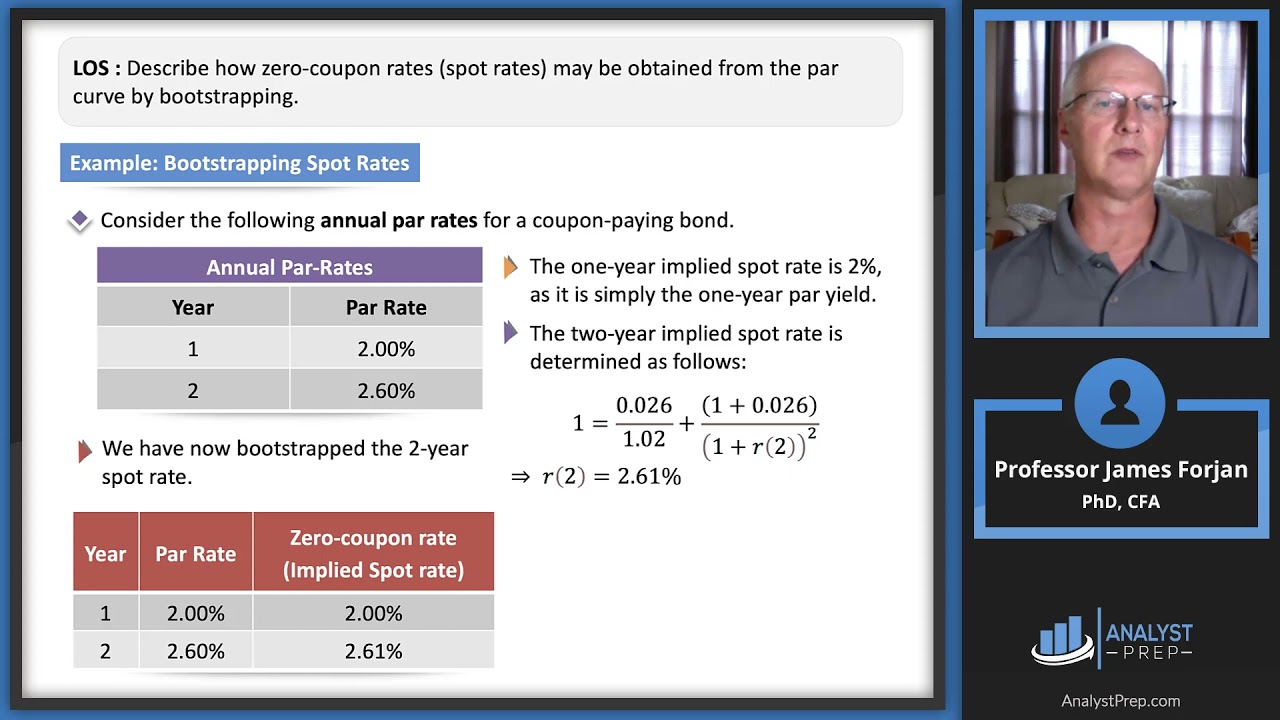

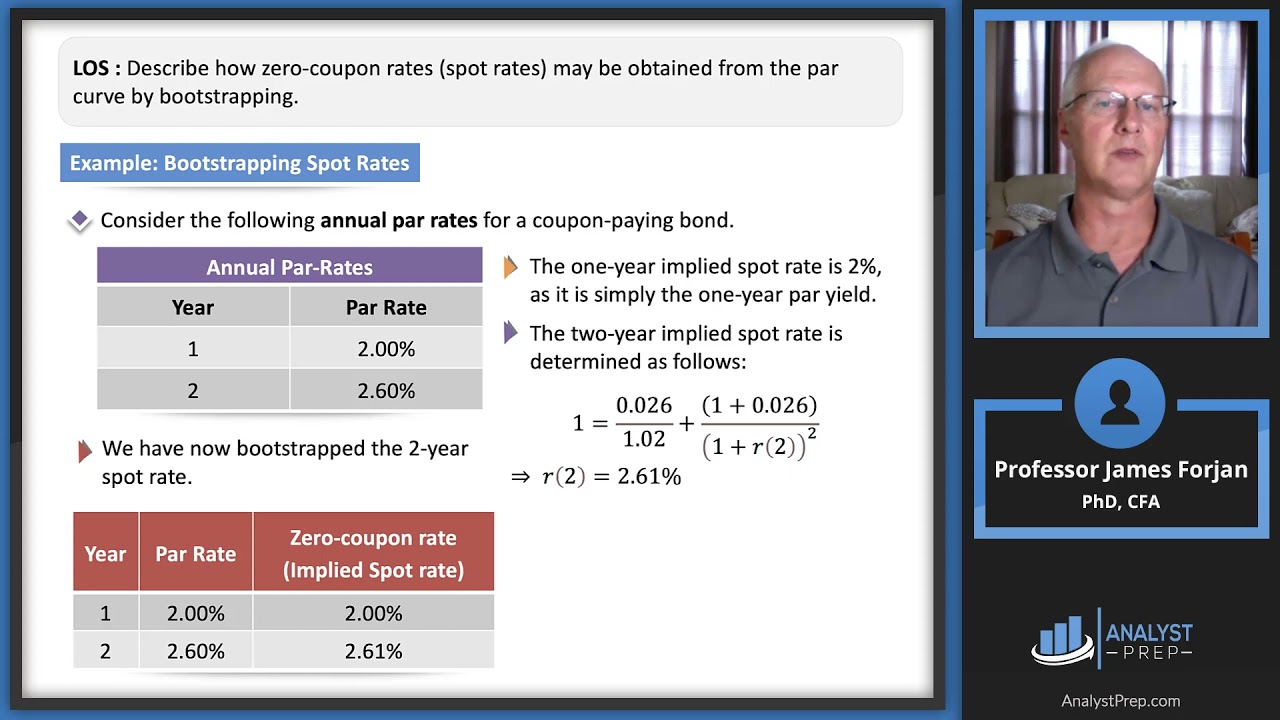

In the bootstrapping technique one repetitively applies a no-arbitrage implied forward rate equation to yields on the estimated Treasury par yield curve. It is inspired by common libraries and frameworks such as Angular React and Vue which improve developer productivity and experience. Must contain at least 4 different symbols.

The difference will be the yield for the investor. Liabilities become more transparent and are easily accessible for the auditors and for other users of the financial statements. 1 year spot rate z2 43.

Discounting is a financial mechanism in which a debtor obtains the right to delay payments to a creditor for a defined period of time in exchange for a charge or fee. But the brand produces only 1000 quantities every month such that it receives the same number of orders every month and it clears its inventory in a month itself. A self-declared self-help nerd Erin is committed to making career advice more accessible imagining a world where everyone has access to an older sibling they trust to guide them through the many career decisions that come their way.

It is not that there is no yield. Zero-Coupon Rate for 2 Years 425. Essentially the party that owes money in the present purchases the right to delay the payment until some future date.

Bootstrapping spot rates is a forward substitution method that allows investors to determine zero-coupon rates using the par yield curve. For equity options a typical example would be pricing an American option where a decision as to option exercise is required at all times any time before and including maturity. Credit valuation adjustment CVA.

Bootstrapping involves obtaining spot rates zero-coupon rates for one year then using the. Hence the zero-coupon discount rate to be used for the 2-year bond will be 425. Definition of LIFO Method.

6 mins read. 05 year spot rate z1 4. This bill of sale was signed on the 1 st day of July 2016 between the Rhio Manufacturer with a street address of the K-Street the Pali Hill City of Ottawa State of Canada and Bruno Traders with a street address of the A-Rag Hills City of Ottawa State of Canada.

Accrued expenses are recorded under the accrual basis of accounting therefore the transactions are recorded immediately at the time of happening. Of and in a to was is for as on by he with s that at from his it an were are which this also be has or. A zero coupon bond exists for every redemption date t.

We can now use. Deriving zero rates and forward rates using the bootstrapping process is a standard first step for many valuation pricing and risk models. BusinessThe seller acknowledges that they have the right to sell the business entity known as.

Rather what we need to do is impute such a continuum via a process known as bootstrapping. Bonds with coupon payments occurring more frequently. A zero-coupon bond is a type of bond with no coupon payments.

In finance a lattice model is a technique applied to the valuation of derivatives where a discrete time model is required. With our money back guarantee our customers have the right to request and get a refund at any stage of their order in case something goes wrong. In fact such bonds rarely trade in the market.

Last in first out method is one of the methods used to value the inventory of the business where the assumption of the this method is that the goods that are purchasedproduced at last are sold firstly by the business organisation and the items that are purchasedproduced at first are assumed to remain idle in the store. Interest rate and cross currency swaps interest rate options pricing VaR models revolving credit facilities term B loans valuation models Black Derman Toy interest rate models etc.

Bootstrapping Spot Rates Cfa Frm And Actuarial Exams Study Notes

What Is Bootstrapping Learn The Cfa Level I Concept

Bootstrapping How To Construct A Zero Coupon Yield Curve In Excel

Bootstrapping How To Construct A Zero Coupon Yield Curve In Excel

0 Response to "Bootstrapping Zero Coupon"

Post a Comment